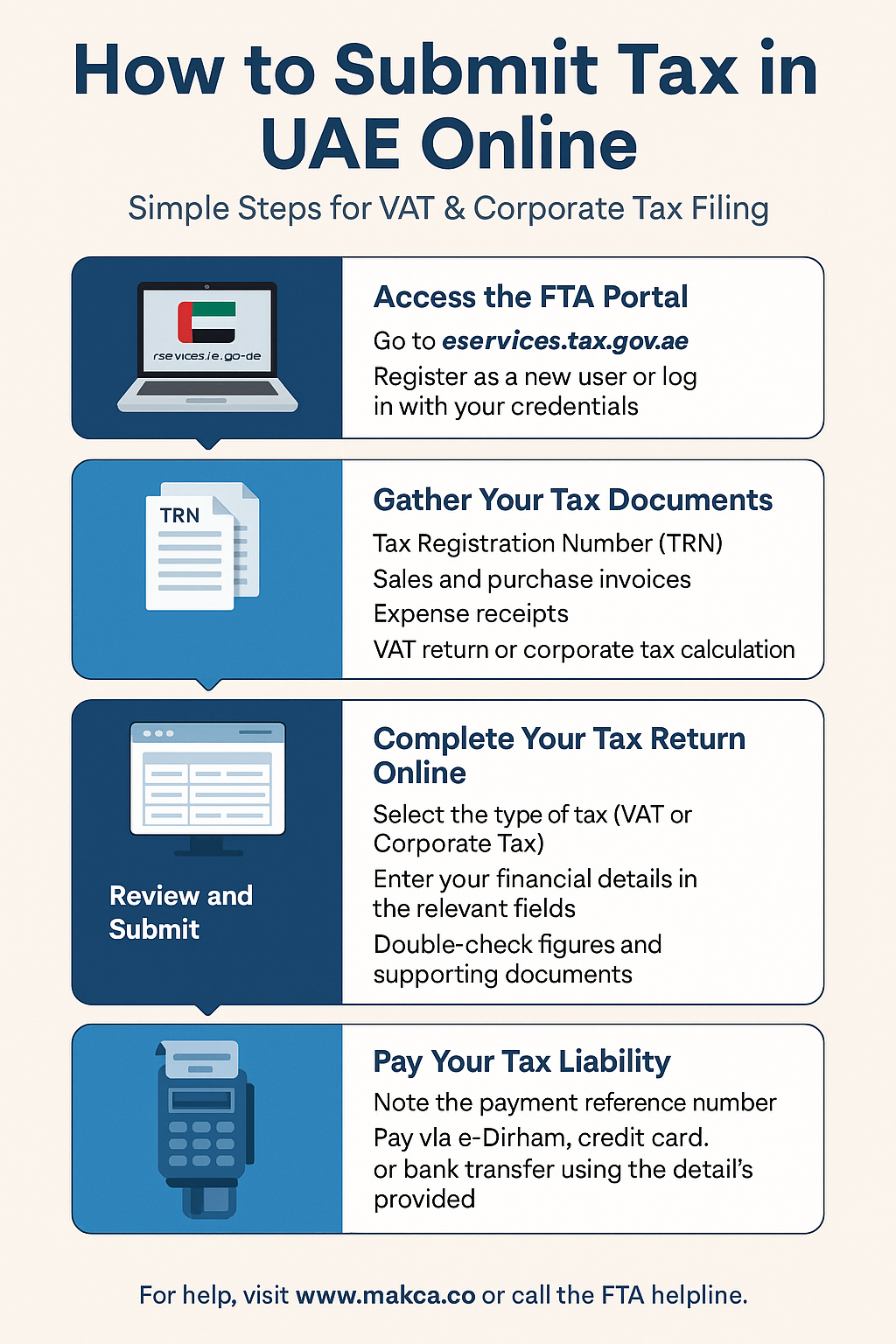

How to Submit Tax in UAE Online

Simple Steps for VAT & Corporate Tax Filing

Table of Contents

ToggleSection 1: Register or Log In

Step 1: Access the FTA Portal

- Go to eservices.tax.gov.ae

- Register as a new user or log in with your credentials

Section 2: Prepare Documents

Step 2: Gather Your Tax Documents

- Tax Registration Number (TRN)

- Sales and purchase invoices

- Expense receipts

- VAT return or corporate tax calculation

Section 3: Fill Out the Tax Return

Step 3: Complete Your Tax Return Online

- Select the type of tax (VAT or Corporate Tax)

- Enter your financial details in the relevant fields

- Double-check figures and supporting documents

Section 4: Submit and Review

Step 4: Review and Submit

- Review your entries for accuracy

- Click ‘Submit’ to send your tax return to the FTA

Section 5: Make Payment

Step 5: Pay Your Tax Liability

- Note the payment reference number

- Pay via e-Dirham, credit card, or bank transfer using the details provided

Section 6: Download Receipt

Step 6: Save Your Confirmation

- Download and save the payment confirmation and filed return for your records